Paypal Continues to Offer You the Nation s Highest Yielding Retail Prime Money Fund

- Get link

- X

- Other Apps

RichVintage/E+ via Getty Images

Investment Thesis

Amazon.com, Inc (NASDAQ:AMZN) has gone on the offensive by announcing its plans to offer 'Buy with Prime' beyond its own platform in the US. Its goal to penetrate the broader e-commerce market is evident through the company's bundled services, including Amazon Pay and Fulfillment by Amazon (FBA), the company's free and fast shipping with free returns. Though Amazon plans to make the feature available to invite-only US retailers first, we expect more online platforms to adopt it once it is available nationwide, and speculatively, globally. The feature would not only provide convenience to many US consumers, but also give US retailers access to Amazon's significant e-commerce market share, which accounts for over 148.6M Prime members as of FY2021.

While we anticipate that PayPal Holdings (NASDAQ:PYPL)'s Venmo digital wallet will lose some market share in the e-commerce segment, its impact will not be significant. We shall discuss why.

With Amazon Encroaching The Online Payment Space, Will PayPal's Growth Suffer?

Amazon Pay is not new, since the digital wallet was introduced by the company back in 2007. Based on its website, Amazon Pay charges a 2.9% domestic processing fee and a $0.30 authorization fee for web and mobile-based transactions, while charging 3.9% for international transactions. In contrast, PayPal's processing rates are in the range of 1.9% to 3.5%, with a fixed fee ranging from $0.05 cents to $0.49.

Though similar in terms of transactional fees, Amazon Pay is still limited to merchants in 18 countries, though consumers are largely able to use the service globally with 12 supported currencies. Though Amazon does not break down its revenues for its Amazon Pay, we believe it would have contributed a decent sum, seeing that the company is eyeing a bigger pie in the payment gateway market through the 'Buy with Prime' feature.

In the meantime, PayPal has been more aggressive in its expansion and operates in over 200 countries with 25 currencies. Besides the usual retail payment gateway, PayPal ( and Venmo ) is also popular for those seeking to receive salaries from global companies, payments from US insurance companies, and tax refunds from the US government. Seeking Alpha itself offers an option to pay its global writers through PayPal, amongst others.

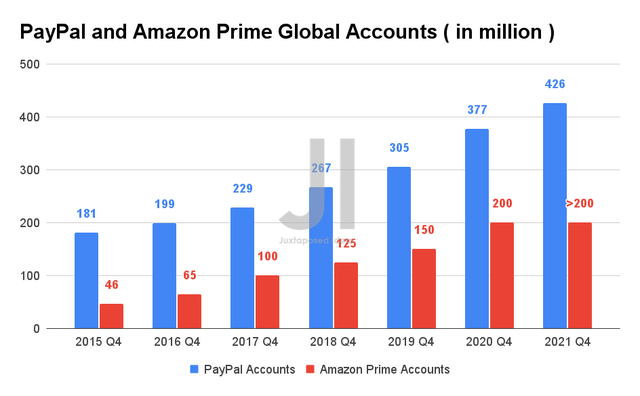

PayPal and Amazon Prime Global Accounts

S&P Capital IQ

If we were to compare their users, PayPal obviously edged out Amazon Prime members with 426M active global users by FY2021, while the latter reported over 200M global Prime members. Why does this matter? Given Amazon's push for 'Buy with Prime,' we expect more Prime members to use the frictionless payment system, compared to PayPal's externalized platform. In addition, since the 'Buy with Prime' feature is expected to be launched in the US ( for now ), we expect PayPal to lose some of its market share in the region, given that there are 148.6M Prime members in the US as of FY2021.

That might be a blow for PayPal, given that 89% of Americans were estimated to use the payment gateway for online shopping in 2021. Nonetheless, given that PayPal is often an individualized account, the scale of its global membership numbers would not be a fair comparison to Amazon, given that the latter allows Prime to be shared among the household.

For FY2021, PayPal reported $13.71B of revenues in the US, accounting for 54% of its global sales then. In contrast, Amazon reported approximately $143.52B of revenue in North America for the retail segment, assuming a flat 60% net sales mix for the region. Nonetheless, since the feature is invite-only for now, its impact on PayPal's future revenues would be minimal momentarily.

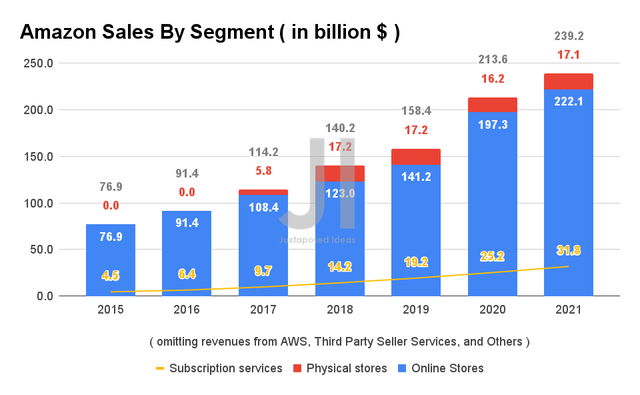

Amazon Sales By Segment

S&P Capital IQ

As with most e-commerce platforms, Amazon experienced exponential growth in its retail sales during the pandemic at a CAGR of 22.89%. The company has also been aggressively growing its Prime revenue in the past three years at a CAGR of 30.8%, while also recording $31.8B of Prime-related subscription fees in FY2021, which is defined as -

Subscription services - Our subscription sales include fees associated with Amazon Prime memberships and access to content including digital video, audiobooks, digital music, e-books, and other non-AWS subscription services. ( Seeking Alpha )

It is evident that Amazon Prime's offering is highly attractive, given that it combines multiple benefits together, including grocery shopping with free deliveries and an online pharmacy prescription, on top of those mentioned above. Furthermore, with Amazon's latest foray into healthcare with Amazon Care, it is a matter of time before its telehealth service is also provided to its Amazon Prime members, for an additional fee. The company had already announced a partnership with Teladoc, offering telemedicine services through Alexa. As a result, the new 'Buy with Prime' feature may grow Amazon Prime's membership further, which has been growing by leaps and bounds in recent years.

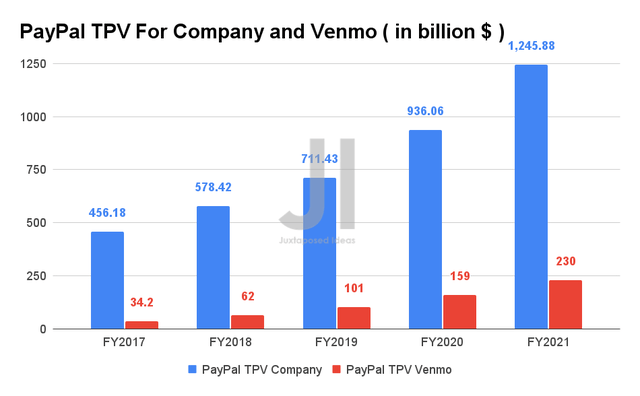

PayPal Total Payment Volume For Company and Venmo

S&P Capital IQ

Nonetheless, it is also important to note that PayPal is more than a payment platform, since it offers a digital wallet in the form of Venmo. For its payment platform alone, the company recorded a CAGR of 28.55% for its Total Payment Volume (TPV) since FY2017. PayPal had also guided for a TPV of $1.5T in FY2022, representing a 20.48% YoY growth. Given that PayPal is a pure payment gateway play as opposed to Amazon's jack of all trades, the former has a higher operating margin of 17% in FY2021 than the latter at 5.3%. The global digital payments market is also expected to grow from $5.05T in 2020 to $9.07T in 2025 at a CAGR of 11%, so it's clearly large enough for multiple big players with different focus segments.

On the other hand, Venmo grew in adoption at a CAGR of 61.04% in the past five years, with an estimated market share of over 29% ( based on a P2P market size of $785.19B) and over 70M users as of FY2021. The management had also guided a 50% YoY growth for Venmo, potentially pushing its FY2022 TPV to $345B, given the growing popularity of its Venmo app. Interestingly, Amazon's previous P2P mobile offering, Amazon Webpay, fell through in 2014, while Venmo flourished after being acquired by PayPal in 2012. Nonetheless, with Amazon launching another P2P offering in India in 2019 via Amazon Pay, we could potentially see the company offering a similar version in the US and globally, assuming a successful pilot there. Finally, with P2P payment transaction volume in the US expected to grow at a CAGR of 14.67% over the next four years, we expect Venmo to grow in relevance over time, while giving room for other competitors such as Block (SQ).

What Does The Future Hold For Amazon & PayPal?

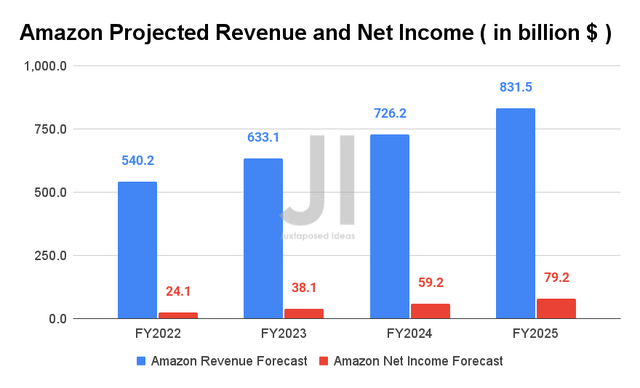

Amazon Projected Revenue and Net Income

S&P Capital IQ

Amazon is expected to grow its revenues at a CAGR of 15.34% over the next four years. Consensus estimates that the company will report FY2022 revenues of $520.2B and net income of $24.1B, representing YoY growth of 14.9% and a decline of 27.7%, respectively. It is evident that macro issues, including the normalization of pandemic growth, moderation in online spending, surging costs from global supply chain issues, higher inflation, and the ongoing Ukraine war is biting back at Amazon's growth.

Nonetheless, it is also important to note that its projected net income margin of 4.46% in FY2022 will remain similar to pre-pandemic levels of 4.1% in FY2019 and 4.3% in FY2018. As a result, there is no need for Amazon investors to be alarmed as the company is still executing brilliantly and is expected to grow its net income margin to 9.5% in FY2025.

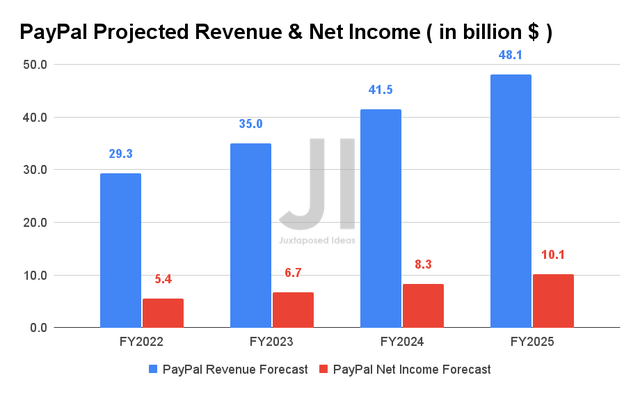

PayPal Projected Revenue and Net Income

S&P Capital IQ

PayPal is expected to grow its revenues at a CAGR of 17.34% over the next four years, with FY2022 revenues of $29.3B and net incomes of $5.4B, representing excellent YoY increases of 15.4% and 29.8%, respectively. Given its asset-light business model, PayPal naturally has a higher net income margin of 16.4% in FY2021, which is expected to improve over the years to 20.9% by FY2025. As a result, it is evident that the fintech market is large enough to accommodate multiple players.

So, Is AMZN & PYPL Stock A Buy , Sell, or Hold?

Amazon is currently trading at an EV/NTM Revenue of 2.8x, lower than its 3Y mean of 3.4x. As a result of the moderation of its valuations, consensus estimates have rated Amazon as attractively priced, given that the stock is also trading at $2887 on 22 April 2022, down 23% from 52 weeks highs of $3773.08. With a lowered guidance in the range of $112B to $117B for FQ1'22 revenues during its previous earnings call, we expect the stock to further retrace in the next few days, as the market pessimism gains momentum, before Amazon reports its earnings on 28 April 2022. As a result, interested tech investors may take this chance to buy during the dip.

In contrast, PayPal is trading at an EV/NTM Revenue of 3.21x, lower than its 3Y mean of 8.42x. As a result of the deceleration of revenue/ account growth and consequently, market correction post FQ2'21 earnings call, the stock has been on a long-term downwards slide, shedding 72% of its value, from the highs of $310.16 in July 2021 to $86.03 on 22 April 2022. Despite its deep global market penetration, PayPal seemed to have reached its saturation point post-pandemic.

In addition, given the rising competition within the US from Amazon Pay and Square (amongst others), we expect a sustained deceleration of growth for PayPal moving forward. Nonetheless, given that its valuation is already at pre-pandemic levels, we expect the stock to bottom out soon, which will prove to be an attractive entry point for a highly successful payment gateway company. We shall see how the market rates PayPal on its next earnings call on 27 April 2022.

Nonetheless, though both companies are solid stocks, if you only have room for one, we recommend Amazon (AMZN), given its excellent execution despite being a jack-of-all-trades stock. In addition, its Amazon Web Services (AWS) is and will continue to be one of the market leaders in the global provider of cloud computing systems for the next generational digital world. Furthermore, the stock has held its value well in the past five years, with over 200% growth in valuation.

Therefore, we rate Amazon and PayPal stocks as Buy for aggressive long-term investors.

This article was written by

I am a full-time analyst interested in a wide range of stocks. With my unique insights and knowledge, I hope to provide other investors with a contrasting view of my portfolio, given my particular background.Prior to Seeking Alpha, I worked as a professionally trained architect in a private architecture practice, with a focus on public and healthcare projects. My qualifications include:- Qualified Person with the Board of Architects, Singapore.- Master's in Architecture from the National University of Singapore.- Bachelor in Arts from the National University of Singapore.If you have any questions, feel free to reach out to me via a direct message on Seeking Alpha or leave a comment on one of my articles.

Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Source: https://seekingalpha.com/article/4503305-paypal-vs-amazon-buy-with-prime-winner

- Get link

- X

- Other Apps

Comments

Post a Comment